stock option tax calculator uk

Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. This would be liable to tax at your marginal rate of income tax - potentially 42 including NI.

Iso Amt Tax Calculator Eso Fund Calculate Employee Stock Options Tax Or Iso Amt Tax Through Eso Fund Our Special Tax Write Offs Tax Deductions Filing Taxes

That means youve made 10 per share.

. As you can probably imagine falling into this. Only for employees tax. Exercising your non-qualified stock options triggers a tax.

As the stock price grows higher than 1 your option payout increases. This permalink creates a unique url for this online calculator with your saved information. If you exercise an option to acquire vested shares in an unapproved share scheme then you will be liable to UK PAYE and National Insurance on the difference between the market value at exercise and the price you paid for the option.

Your source for the latest on options and the most innovative companies to invest in. Enter as many assets as you want and make sure you have entered your other income and any losses you are carrying forward from previous years. The rate of CGT on the disposal of the shares in the UK can be as low as 10 per cent.

Please enter your option information below to see your potential savings. There are two types of taxes you need to keep in mind when exercising options. Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options.

Abbreviated Model_Option Exercise_v1 -. Decide on your strategy. Cash Secured Put calculator addedCSP Calculator.

UK Capital Gains Tax Calculator. The first category is speculative in nature and similar to gambling activities. As of 2009 the long-term capital gains tax rate is 15 per cent.

Use this calculator to determine the value of your stock options for the next one to twenty-five years. Poor Mans Covered Call calculator addedPMCC Calculator. If you fall under this bracket any day trading profits are free from income tax business tax and capital gains tax.

The Stock Calculator is very simple to use. Support for Canadian MX options Read more. 60 of the gain or loss is taxed at the long-term capital tax rates.

40 of the gain or loss is taxed at the short-term capital tax rates. Enter the commission fees for buying and selling stocks. The issue of stock options under an advantageous plan should also mitigate any social security payable by both the employee and employer as compared to non-qualifying stock options.

So if you have 100 shares youll spend 2000 but receive a value of 3000. How much are your stock options worth. Our Capital Gains Tax Calculator is a really simple way to quickly calculate the possible liability you have for CGT against any assets you have disposed off.

Click the view report button to see all of your results. Sell Vests assumes you sell immediately upon vesting shares while Hold All assumes you. CGTcalculator is an online capital gains calculator for UK share trades.

Typically the scheme administrator would. At the point of exercise there are usually three options available as follows. Input your current marginal tax rate on vesting RSUs.

If youre considering offering UK employees stock options your HR and tax. You can deduct certain costs of buying or selling your shares from your gain. Non-tax favored Options UK ISO US NSO US Restricted Stock US Restricted Stock UK Summary.

Important Note on Calculator. In our continuing example your theoretical gain is zero when the stock price is 1 or lowerbecause your strike price is 1 you would pay 1 to get 1 in return. Consult with a tax professional if.

Ordinary income tax and capital gains tax. There is also a tax calculator that. IV is now based on the stocks market.

Enter the purchase price per share the selling price per share. Abbreviated Model_Option Exercise_v1 - Pagos. Enter the number of shares purchased.

Enter the amount of your new grant - whether an offer grant or an annual refresh. Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share. Locate current stock prices by entering the ticker symbol.

To use the RSU projection calculator walk through the following steps. The amount of tax youre charged depends on which income tax band you fall into. On the date of exercise the fair market value of the stock was 25 per share which is reported in box 4 of.

If the exercise price is 10 and you have 100 NSOs you would pay the company 1000 to exercise your 100 NSOs and the company would give you shares of stock. Broadly speaking basic-rate taxpayers are charged 10 while higher-rate taxpayers must pay 20 in CGT. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share of company stock.

Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional. You may need to pay capital gains tax CGT on shares you own if you sell them for a profit. Section 1256 options are always taxed as follows.

NSO Tax Occasion 1 - At Exercise. Equity option positions held for less than a year result in short-term capital gains treatment. Estimate how much your RSU value will increase per year.

Buy the shares outright and pay the tax and NI charge in full. Per IRS Topic 409 if you trade in LEAP long-term equity anticipation options and hold the position for over a year then the proceeds qualify as a long-term capital gain. Just follow the 5 easy steps below.

However if youre a basic-rate taxpayer the gain you make when. By changing any value in the following form fields calculated values are immediately provided for displayed output values. You paid 10 per share the exercise price which is reported in box 3 of Form 3921.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again. The taxation of options contracts on exchange traded funds ETF that hold section 1256 assets is not always clear.

It implements the Inland Revenues onerous share matching rules and in addition calculates taper relief based on the asset type of the share. Normal capital gains tax rules apply on the sale and you will pay tax at any gain above the annual exemption at either 18 or 28 depending upon your income elsewhere. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Stamp Duty Reserve Tax. Taxes for Non-Qualified Stock Options. Fees for example stockbrokers fees.

Find the best spreads and short options Our Option Finder tool now supports selecting long or short options and debit or credit spreadsTry it out.

Eso Fund Helps You To Plan The Best Time To Exercise Your Employee Stock Options Consider Some Factors Like Vesting Date Expirati Stock Options Incentive Tax

Option Greeks Calculator Live Excel Sheet Excel Options Trading Strategies Stock Options Trading

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Budget 2019 Revised Section 87a Tax Rebate Tax Liability Calculation Illustration Income Tax Tax Deductions List Tax Deductions

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To View And Download Your Tax Documents

How To Set Tax Percentage On Calculator Easy Way Youtube

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Mortgage Calculator Plus Mortgage Calculator Mortgage Calculator

How Is Taxable Income Calculated

Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21 Income Tax Slabs 2020 21

Income Tax Calculator For Fy 2021 22 Ay 2022 23 Free Excel Download Commerceangadi Com

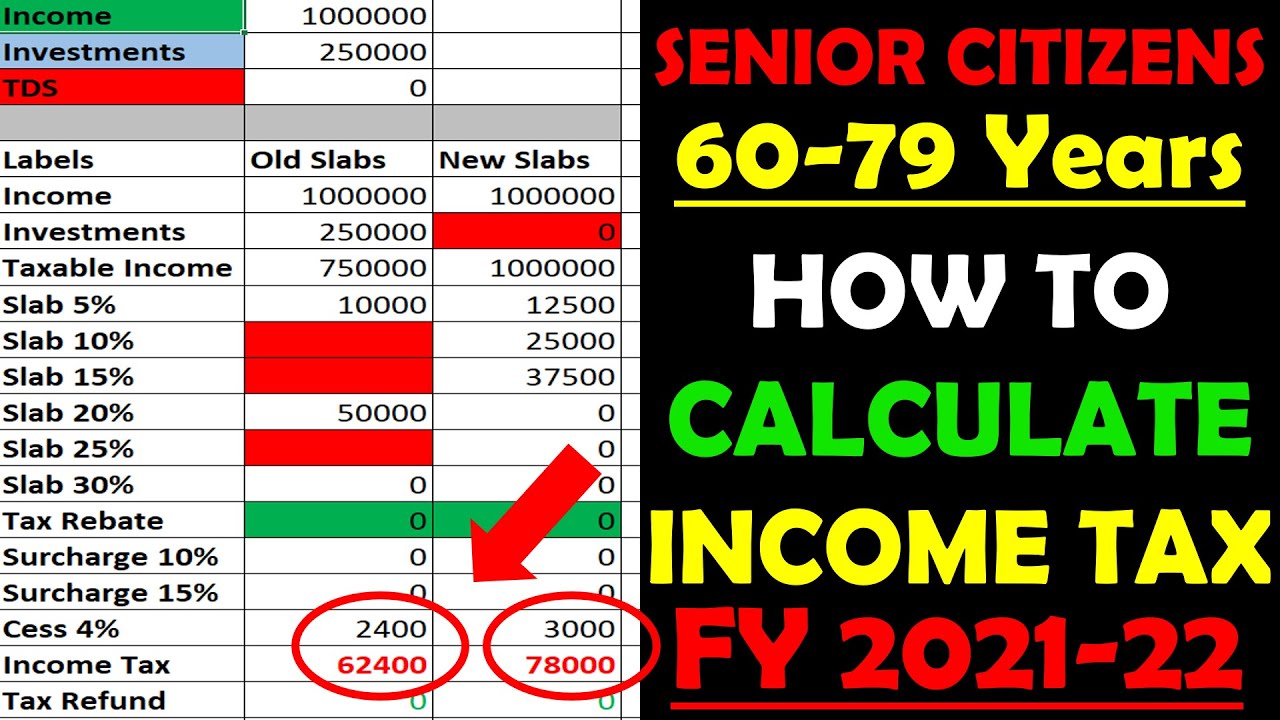

How To Calculate Income Tax Fy 2021 22 Excel Examples Senior Citizens Age 60 To 79 Years Youtube

Get Your Personal Taxreturn Filed So That You Can Enjoy The Holidays Taxreturn 99 31st January Is Your Certified Accountant Tax Return Accounting

Income Tax Calculator For Fy 2020 21 Ay 2021 22 Excel Download